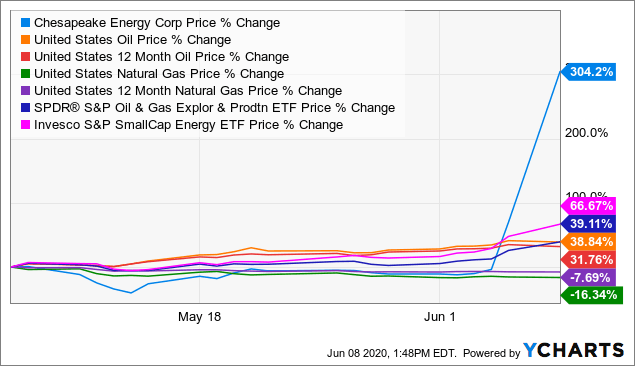

In Chesapeake's case, even if it ends up being an $8 billion or $10 billion company again sometime post-restructuring, that won't benefit current common shareholders. With some bankruptcies, common shareholders get a small percentage of the new equity, so there is at least some potential to benefit from post-restructuring improvements in the company's value. The high cost to short may help keep Chesapeake's shares afloat for the time being, but common shareholders should be aware enough to sell before the shares are cancelled. The cost to short has been around 300% per year recently, so if Chesapeake's shares stay at $7 and then get cancelled in five months, the cost to short it over that time may be over $8 per share if the cost to short remains at 300%. Although the long-term value of Chesapeake's current common shares is zero, it may be challenging to make money shorting the common shares due to the high cost to short. Despite this, Chesapeake's common shares were still trading at $7 per share recently. Equity To Be CancelledĪs expected, Chesapeake's common and preferred shares are going to be cancelled without any recovery.

Chesapeake's second-lien and unsecured bonds have upside potential, although that will depend on improving oil and/or gas prices as the upside is significantly tied to the warrants having value.

As I noted before, Chesapeake Energy ( CHKAQ) looked likely to file for bankruptcy by July due to the large second-lien bond interest payment that it was unlikely to pay given the market conditions.Ĭhesapeake's common and preferred equity will see zero recovery according to the Restructuring Support Agreement.

0 kommentar(er)

0 kommentar(er)